ClearPoint Neuro, Inc.: Unleashing the 2017 Adjacent Possible into Reality - NOW!

Wednesday, September 10, 2025 | by Michael Bigger and Mathias Bigger |

In this article, I explore how that hidden potential—the adjacent possible envisioned in 2017—has now become reality and aim to answer How Big can CLPT become over the next 3 to 10 years.

(I will not address the financial results over short durations (less than 3 years). Nor will I be discussing neurosurgery navigation and capital equipment which analysts such as Anderson Schock at B Riley Securities (PT: $28) and Frank Takkinen at Lake Street (PT: $30) cover in great detail. I recommend reading their CLPT reports.)

On Wednesday, September 6, 2017, I highlighted a remarkable investment opportunity in MRI Interventions, Inc. in my post titled 100 to 1 - MRI Interventions, Inc. (Bigger, 2017). Back then, I introduced the company as follows:

While the revenue-generating core of MRIC supports 10x potential, it’s the hidden and explosive side of the business that fuels our excitement for a 100 to 1 outcome.

and concluded our analysis with:

One approval is all that’s needed to create stratospheric value for the company and its shareholders, and to move the potential needle from a 10 to 1 to a 100 to 1.

The Functional business and the Drug Delivery business could generate close to $200 million annual revenues in about 10 years. Yes, a large portion of this number is binary in nature, but a healthy dose of diversification already exists in the portfolio of cutting-edge biotech companies.

The potential in the surprise bucket is also very alluring.

We believe that owning MRIC gives us a good shot at a 10 to 1 upside potential and if something goes right in the other two buckets, a 100 to 1 payoff is not a crazy idea.

Tail, I win, and Head I just kill it!

Today, ClearPoint Neuro has transformed its innovative neuro-drug vision - the “explosive side of the business” or “surprise bucket” - into a tsunami of revenue potential, fortified by network effects and a competitive moat. This is the result of hard work and a sharp focus on the adjacent possible by CLPT.

Hidden Potential. Understanding the Adjacent Possible with GROK’s Help

The concept of "harvesting the adjacent possible" refers to identifying and capitalizing on opportunities that are just one step beyond the current state of affairs - new possibilities that are feasible given existing technologies, knowledge, or conditions. This idea, popularized by Steven Johnson in “Where Good Ideas Come From” (Jognson, 2010), suggests that innovation often emerges from recombining existing ideas, tools, or resources in novel ways. When paired with the potential for “exponential return outcomes”, this approach becomes a powerful framework for generating significant value, particularly in dynamic fields like technology, business, or science.

The adjacent possible is the set of opportunities that are realistically achievable given the current state of a system. It represents the "next steps" that can be taken by leveraging existing resources, knowledge, or technologies. For example:

- In technology, the invention of the smartphone opened the adjacent possible for app ecosystems, mobile internet, and location-based services.

- In biology, a mutation in a gene might create new possibilities for evolutionary adaptations that were previously inaccessible.

The adjacent possible is inherently incremental - it’s not about leaping to far-fetched ideas but about exploring what’s just beyond the horizon. However, these small steps can compound over time, leading to transformative outcomes.

Exponential Return Outcomes

Exponential returns occur when the impact or value of an action grows non-linearly, often at an accelerating rate. This is common in systems that exhibit network effects, compounding growth, or positive feedback loops. Examples include:

-Technology: Software platforms like social media networks grow exponentially as more users join, increasing the platform’s value (e.g., Metcalfe’s Law).

-Investments: Compound interest or early investments in high-growth startups can yield exponential financial returns.

-Innovation: A single breakthrough can unlock a cascade of further innovations, each building on the last, like an avalanche.

Exponential returns are often associated with scale, where small initial advantages or innovations amplify over time due to feedback mechanisms or widespread adoption

Exponential Return Outcomes from the Adjacent Possible: Examples:

1. Technology (AI):

- The adjacent possible in AI involved building early neural networks to create deep learning models. Companies like OpenAI or DeepMind capitalized on these incremental advances, leading to exponential outcomes in applications like ChatGPT or AlphaFold, which transformed industries.

2. Business (Amazon):

- Amazon’s move into cloud computing with AWS was an adjacent possible step, leveraging its existing server infrastructure. This led to exponential returns as AWS became a dominant player in a rapidly growing market.

3. Finance (Cryptocurrencies):

- Bitcoin’s creation was an adjacent possible step, combining cryptography, distributed systems, and existing internet protocols. Early adopters who recognized its potential reaped exponential returns as adoption grew.

4. Science (CRISPR):

- CRISPR gene-editing technology built on decades of molecular biology research. Its development opened the adjacent possible for precise genetic therapies, with exponential potential to revolutionize medicine.

5. Science (Precise Delivery of Gene Therapies to the Brain):

- CLPT….

2017 CLPT

In 2017, CLPT was already advancing MRI-guided neurosurgery, but its role in enabling breakthrough brain therapeutics was an "adjacent possible" idea-building on existing MRI technology and stereotactic navigation to deliver novel therapies. From our knowledge, CLPT had 5 active partners in neuro-drug delivery that were in early clinical studies with nothing on the short-term horizon in terms of approval. This was the adjacent possible – a feasible step forward that opened new doors in neurosurgery, biologics delivery, and gene therapy. It would take another 7 years for a partner’s therapeutic to reach commercial status.

Figure 1: Slide 9 of Clearpoint Neuro, Inc.’s August 2025 Presentation (CLPT,2025)

2025 CLPT

On November 13th, 2024 ClearPoint Neuro announced FDA De Novo Marketing Authorization of SmartFlow Cannula for Direct Delivery of Gene Therapy to the Brain. This watershed event strengthened my conviction that ClearPoint Neuro then entered its exponential growth phase, aligning perfectly with the concept of harvesting the adjacent possible for outsized returns

"Today is one of the most important strategic milestones in the history of our company," commented Joe Burnett, President and CEO at ClearPoint Neuro. "FDA's granting of this De Novo classification is the culmination of years of disciplined co-development, creative problem solving, and tireless efforts. We could not be prouder of the PTC and ClearPoint Teams and how we have worked together. Most importantly, we are thrilled and humbled that children with this terrible disease will now be treated with the first-ever neuro gene therapy available commercially in the United States."

Today, the company has 60 active partners, some with multiple programs, in neuro-drug delivery including FDA-approved gene therapy delivery (KEBILIDI™), nine partner programs with expedited review designations including for Huntington's disease (AMT-130) and epilepsy (NRTX-1001), and other significant neurological diseases and expanded CT-compatible platforms that will ignite CLPT revenues in the next couple of years. ClearPoint cracked the code and is firmly entrenched in its “Fast. Forward.” growth phase (Figure 2). With $500 million in market opportunity over the next 3 years, ClearPoint might exit 2027 with a significant multiple of 2024 revenues ($31.4 million).

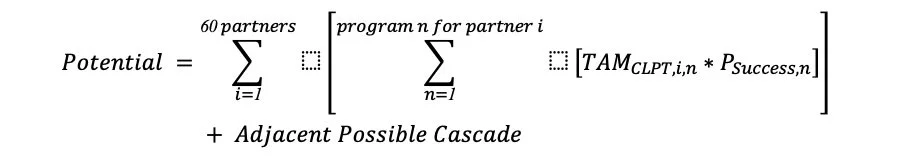

The nested summation term in formula 1 is how we look at the massive potential of the current shots on goal. The Adjacent Possible Cascade term refers to the amplification from new partnerships with new pipelines, cutting edge development, and the unknown possibilities.

Formula 1: The Probalistic Potential of Clearpoint Neuro, Inc.

Let’s look at the numbers:

Figure 2: Slide 8 of Clearpoint Neuro, Inc.’s August 2025 Presentation (CLPT, 2025)

● PTC Therapeutics: There are 288 new cases a year of AADC Deficiency (Source: Grok). Assuming 50% penetration rate at $20,000 per patient that would contribute $3 million a year to CLPT’s business.

● uniQure: uniQure is expected to announce 3-year Huntington’s disease pivotal data for AMT-130 this September and to file its Biologics License Application (BLA) in the first quarter of 2026 followed by an FDA decision in the fall of 2026. (This timeline is based on the company’s alignment with the FDA on the statistical analysis plan and Chemistry, Manufacturing, and Controls (CMC) requirements.) Approximately 41,000 patients suffer from Huntington’s disease in the USA and 70,000 globally. (huntingtonsdiseasenews.com) Assuming an extremely conservative 5,000 patients per annum being treated with AMT-130, CLPT could generate about $100,000,000 in annual sales starting in 2027. That would push the company into cash flow positive territory.

● BlueRock Therapeutics: Blue Rock’s Phase 3 exPDite-2 Trial planned to initiate in the first half of 2025, marking the first registrational Phase III trial for an allogeneic pluripotent stem cell-derived therapy for PD. Bemdaneprocel has received FDA Regenerative Medicine Advanced Therapy (RMAT) and Fast Track designations, facilitating accelerated development and regulatory discussions. (bayer.com). Approximately 90,000 people are diagnosed with Parkinson’s disease (PD) each year in the United States. Assuming a 5% penetration rate that is $90 million of revenue a year for CLPT.

● Neurona: Neurona’s Phase 3 EPIC Study for NRTX-1001 Cell Therapy in Epilepsy trial enrollment starts 2H 2025, with interim data in 2026, and potential approval in 2027–2028. In the Phase 1/2 clinical trial for NRTX-1001, one patient with a 7-year history of seizures, averaging 32 seizures per month in the 6 months prior to treatment, experienced a 98% reduction in disabling seizures 19 months post-treatment. This patient, treated with a single low-dose, reported sustained seizure control after completing a 12-month immunosuppression regimen, with no study-related adverse effects. (Neurona Therapeutics, 2025). During 2021 and 2022, about 2.9 million U.S. adults 18 and older reported having active epilepsy (Kobau, 2024). 5% market penetration by one of CLPT partners could result in billions of dollars in revenues.

● Additional Expedited Review Partners 5-7: We asked Grok about the approval rating at this stage of development.

The approval probability is different (lower) for drugs targeting Central Nervous System (CNS) diseases with FDA expedited review designations (e.g., Breakthrough Therapy, Fast Track, RMAT) that haven't completed pivotal trials yet. The estimated eventual approval rate from this stage is ~50%, compared to ~70% overall. This accounts for the inherent challenges in CNS drug development, such as complex biology, blood-brain barrier issues, higher failure rates in demonstrating efficacy, and safety concerns. (GROK 4 HEAVY).

We believe that this 20% delta is much lower in the case of CLPT because crossing the blood-brain barrier is a non-issue. Nonetheless, using a 50% probability of approval for these 7 partner programs in their late-stage clinical trials, it is not hard to imagine 2 to 5 of these programs crossing the finish line in the next 5 years.

● Earlier Stage Partners: All of the earlier stage partner programs (a multiple of 60) are advancing strongly. At a minimum, the probability of success for these programs is 10%. This is tremendous value creation potential that will be realized in the future. Keep in mind, in 2017 uniQure and Neurona were not even on my radar screen.

2028 +

The company expects to gravitate into its “Essential. Everywhere.” phase of development in 2028 and beyond with $10 billion Potential Annual Revenue Opportunity. We believe this metric is conservative when put into perspective of the $800 billion annual cost (Figure 3).

Figure 3: Slide 5 of Clearpoint Neuro, Inc.’s August 2025 Presentation (CLPT, 2025)

Action on Our Conviction

Bigger Capital has been building its CLPT over the last 10 years, and we filed this 13G/A. Recently, we’ve accelerated our purchases of CLPT as we await its “pig through a python” moment. We’re that excited about the opportunity.

Of Interest:

· MRI Interventions to Present at the 2017 MicroCap Conference on October 5

Michael Bigger. Follow me on Twitter and StockTwits.

Mathias Bigger. Follow me on Twitter.

Disclaimer: Bigger Capital Fund, LP and related entities are long CLPT. The outcome of an investment could result in a loss of principal. Please do not rely on our views, instead use the information as a jumping off point to begin your own independent due diligence.

Citations

Bigger, M. (2017, September 6). 100 to 1 - MRI Interventions, Inc. Bigger Capital Fund, LP. https://static1.squarespace.com/static/685da928795439155828b657/t/688a39b06334e320158d6409/1753889200681/100+to+1+MRI+Interventions%2C+Inc.+September+6%2C+2017.pdf

CLPT. (2025, August). WHEN YOUR PATH IS UNCLEAR, WE POINT THE WAY. Clearpoint Neuro Inc. https://d1io3yog0oux5.cloudfront.net/_b5b0ec57d7a7b5cf1ca753da00837900/clearpointneuro/db/77/2903/pdf/CLPT+Investor+Deck_August+2025.pdf

Johnson, S. (2010, July). Where good ideas come from. TED. https://www.ted.com/talks/steven_johnson_where_good_ideas_come_from

Kobau, R. (2024, August). About 1.5 million community-dwelling US adults with active epilepsy reported uncontrolled seizures in the past 12 months, and seizure control varied by annual family income—National Health Interview Survey, United States 2021 and 2022 - Epilepsy & Behavior. Epilepsy and Behavior. https://www.epilepsybehavior.com/article/S1525-5050(24)00233-6/abstract

Neurona Therapeutics. (2025, June 18). Neurona doses first patient in phase 1/2 trial of NRTX-1001 cell therapy in adults with drug-resistant, bilateral Mesial Temporal Lobe Epilepsy (MTLE). BioSpace. https://www.biospace.com/press-releases/neurona-doses-first-patient-in-phase-1-2-trial-of-nrtx-1001-cell-therapy-in-adults-with-drug-resistant-bilateral-mesial-temporal-lobe-epilepsy-mtle